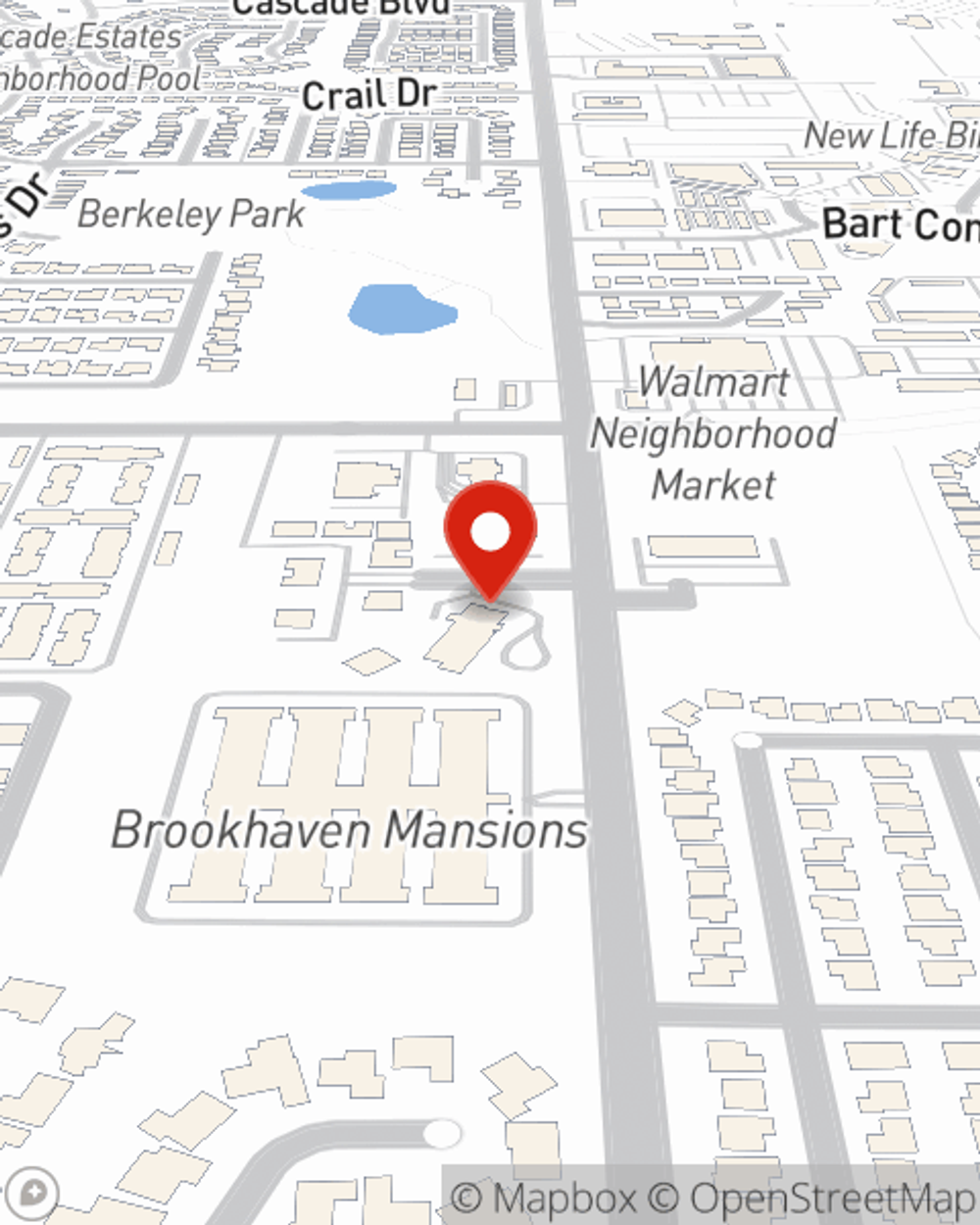

Condo Insurance in and around Norman

Get your Norman condo insured right here!

Quality coverage for your condo and belongings inside

- Norman

- Moore

- Oklahoma City

- Blanchard

- Goldsby

- Noble

- Lexington

- Newcastle

- Mustang

- Midwest City

- Del City

- Purcell

- Yukon

- Bethany

- Edmond

- Piedmont

- El Reno

- Tuttle

- Choctaw

- Washington

- Guthrie

- Chickasha

- McCloud

- Harrah

Home Is Where Your Condo Is

When you think of "home", your condo is first to come to mind. That's your retreat, where you have made and are still making memories with the ones you love. It doesn't matter what you're doing - cooking, recharging, playing - your condo is your space.

Get your Norman condo insured right here!

Quality coverage for your condo and belongings inside

State Farm Can Insure Your Condominium, Too

You want to protect that important place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as smoke, hail or fire. Agent Greg Ellis can help you figure out how much of this great coverage you need and create a policy that has what you need.

Don’t let worries about your condo stress you out! Get in touch with State Farm Agent Greg Ellis today and see how you can benefit from State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Greg at (405) 321-0600 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.